Bears took control of the trade floor on Thursday at the Pakistan Stock Exchange (PSX) as shares declined by nearly 2,000 points on “deteriorating relations with Afghanistan”.

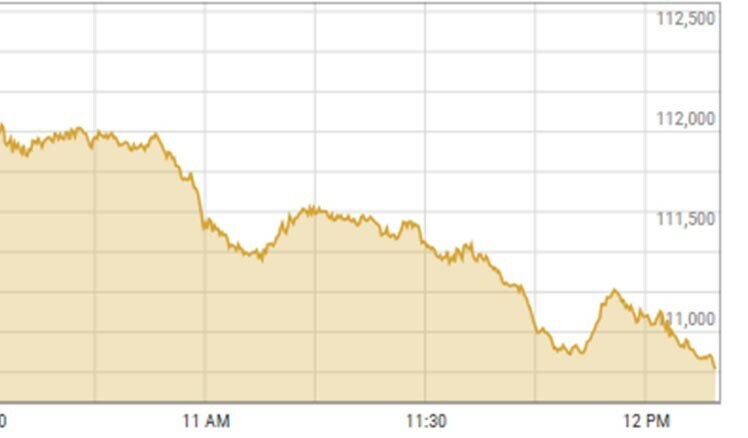

The benchmark KSE-100 index declined by 1,365.18, or 1.21 per cent, to stand at 111,049.62 points at 12:17pm from the last close of 112,414.80.

It then downslided further to 110,521.28 points at 2:05pm, marking a decline of 1,893.52 points from the previous close.

Finally, the index closed at 110,423.32, down by 1991.48 points or 1.77pc, from the last close.

Yousuf M. Farooq, director research at Chase Securities, attributed the decline to deteriorating relations with Afghanistan, which he said were being discussed by investors today, following a reported air strike by Pakistan on terrorist camps in the neighbouring country.

“Despite this, market trailing earnings yields remain above the long-term average, indicating the potential for above-average long-term returns for investors,” he added on a positive note.

“In the short term, the market’s direction is being influenced by political noise following a significant rally over the past year,” he underscored.

Meanwhile, Mohammed Sohail, chief executive of Topline Securities, credited the bearish momentum to “rising leverage and ending December contract” impacting the market.

“Moreover, ongoing security situation at the borders affecting sentiments,” he said.

Awais Ashraf, director research at AKD Securities, credited the momentum to the “realignment of portfolios at the year-end and last week of rollovers of future contracts”.

“Concerns regarding unification of gas prices exerting pressure on most weighted stock while there is a concern of overvaluation on some stocks,” he highlighted, adding that he believed “falling interest rates and lower returns of alternative investments would keep the equities in limelight”.

“We advise investors to build positions in E&P, Fertiliser, Cement, OMCs [Oil Marketing Companies], Autos, Textile and Technology as we expect these sectors to be the beneficiary of monetary easing, structural reforms and declining commodity prices,” he recommended.

Yesterday, after two straight recovery sessions following a ruthless bloodbath in the last week, the bears again drove the bulls out of the stock market, causing investors a staggering loss of Rs690 billion in a single day.

Analysts had attributed the market downturn to profit-taking witnessed amid pressure on future contracts’ rollover and uncertainty over the outcome of the government and PTI reconciliation talks.

Additionally, the momentum was attributed to weak rupee, falling global crude oil prices and institutional selling in overbought scrips fuelled bearish activity at PSX.

Dear visitor, the comments section is undergoing an overhaul and will return soon.